10 Essential Insights into the Indian Stock Market for Wealth Creation

Introduction to the Indian Stock Market

A stock market is a platform or a place where buyers or sellers come together and exchange shares among each other which represent the ownership of the company. This exchange can be done physically at a place like Dalal Street in Mumbai for NSE & BSE and The Wall Street in New York for NASDAQ & Dow. Nowadays there are virtual platforms that simplify the buying and selling of these stocks from the comfort of the home for example Zerodha, Dhan, and Groww.

There are some key components in a stock market :

- Stocks – Stocks are investment instruments or assets that give you direct ownership of a company. for example – if you buy 5 shares of ICICI BANK it means you are a direct owner of ICICI BANK.

- Stock Exchanges – These are the institutions or regulatory bodies that regulate the buying & selling of the shares. These regulatory bodies make sure that no illegal activities take place in the stock market.

- Investors – Individuals or institutions that buy and sell shares in the stock market are referred to as investors.

There are a lot of major components in the stock market and we will learn about them further ahead.

Importance of Stock Market

Capital Formation

- For companies – With the help of the stock market companies list their shares on exchanges with the help of an Initial Public Offering (IPO) and raise capital which is ultimately utilized for the expansion, research, development, and other business activities.

- For investors – Investors simply buy shares and hold them for some time and earn money through dividends and capital appreciation.

Economic Indicator

The stock market growth of a company shows the economic health of a country. Increasing stock prices shows an increase in the economy of a country and a fall in the prices of stocks leads to a decrease in the GDP and economy of a country.

Wealth Creation

Long-term investment in stocks can lead to the creation of generational wealth. Historical data proves that stocks have outperformed all other asset classes in the long run.

Liquidity

The stock market is an easily accessible platform for investors who want to buy and sell shares to create some passive income. Digitalization in the markets has made it more liquid and flexible when it comes to investors.

Diversification

Investors get a large option for diversification when it comes to investing in stocks of different sectors and different sizes just to control the risk and enhance the returns possible for the stock markets.

Financial Inclusion

People of all classes and financial backgrounds can participate in markets and economic growth of the nation and it is also helpful in the wealth creation of an individual too.

History of Indian Stock Markets

The history of Indian stock markets goes back 150 years pre-independence era of India and shows significant growth and development of the country’s economic evaluation.

Early beginning & Establishments

In 1875, the Bombay Stock Exchange(BSE) was established as a Native Stocks and Share Association and this was Asia’s oldest stock exchange. In the 1920s – 1930s, many regional stock exchanges started to get established in locations like Chennai, Ahmadabad, and Calcutta.

Post-Independence Era

After India gained independence, in the era of 1950s-1970s government started focusing on industrialization and PSU started taking the lead in the growth of the economy.

Modernisation and Expansion

In 1992, the Securities and Exchange Board of India (SEBI) & National Stock Exchange (NSE) was established. SEBI was incorporated as a regulatory body that oversees market activities, enhances transparency, and protects investor interests.

On the other hand, NSE was established to introduce electronic trading and also to compete with the monopoly Bombay Stock Exchange (BSE).

Recent Growth & Development

A decade later markets started to grow significantly in the year of 2010s with multiple IPOs, and an inflow of capital from foreign markets because of rising integrity with foreign nations. After the Covid pandemic markets showed a drastic recovery with the introduction of many new trading and investing instruments.

How does the Stock Markets work in India?

After the incorporation of SEBI, the Indian stock markets started working in a structured and more centralized manner as compared to earlier and this thing always improved with time. Generally, there are two types of markets –

Primary vs. Secondary Markets

Primary Markets

- Purpose– This is the market where new shares are issued for the first time and further traded in the markets.

- Initial Public Offerings(IPOs) – Whenever a company requires capital for their day-to-day functioning or debt consolidation or exit of promoters they generally list their companies in markets via an IPO and raise money.

IPOs demand three major steps to be completed before listing :

- Filing a prospectus with SEBI.

- Setting a price band or fixed price.

- Allotting shares to investors after the subscription period.

- Other Instruments – This includes some other corporate actions such as rights issues, offers for sale (OFS), private placements, preferential shares issues, bulk deals, etc.

Secondary Markets

- Purpose– This is generally known as the retail stock market because the already listed companies’ shares are traded here.

- Stock Exchanges – There are two major stock exchanges namely the National Stock Exchange (NSE) & Bombay Stock Exchange (BSE).

- Trading Process – Investors buy and sell shares according to their analysis with the help of a stockbroker.

- Market Indices – There are two major indices of Indian markets such as Nifty50 representing NSE including the Top 50 companies of the economy. On the other hand, Sensex represents BSE with 30 companies being its components.

Stock Market Participants

Retail Investors

Those investors who invest in markets individually for a small amount on a random event of time are referred to as retail investors. They generally have a small capital to invest and a motive to diversify investments in different asset classes.

Institutional Investors

These are a pool of investors coming forward to invest in markets with similar investment goals with large amounts of money. Some famous institutional investors are Mutual Funds, Pension Funds, Insurance companies etc.

Foreign Institutional Investors (FIIs)

Foreign investors that invest in Indian stock markets are known as FIIs. These investors provide liquidity in the market and also invest a large amount of money because of higher currency value.

Domestic Institutional Investors (DIIs)

Indian financial institutions such as banks, NBFCs, mutual funds, and insurance companies primarily invest as institutions and are known as DIIs.

Stock Market Indices

Sensex of Bombay Stock Exchange (BSE)

Sensex is constituted of India’s top 30 financially sound companies that are well established in terms of operations and brand trust across the nation.

It acts as an indicator to show the country’s economic strength.

Nifty 50 of the National Stock Exchange (NSE)

This index comprises India’s largest 50 and most liquid stocks listed on exchanges. This is a widely used benchmark index of India that shows the strength of the Indian economy to the world.

Types of Stocks and Their Characteristics in India

There are different types of stocks with different characteristics of its own. In this section, we will understand different types of stocks so that we can invest according to our needs.

Common (Equity) Stocks

It is one simple stock or equity that represents the ownership in a company. These stocks provide you with multiple features such as voting rights, dividends, capital appreciation, and also some risk along with such benefits.

Preferred Stocks

Represent ownership in a company with preferential treatment over common stock in terms of dividend payments and asset liquidation. Preferential stockholders get prioritized dividends often at a fixed rate.

Stockholders get higher claims on assets than ordinary shareholders and do not have any voting rights.

Blue-Chip Stocks

These are the stocks of the companies that are well-established, financially sound, companies with reliable past performance records. These stocks have a highly reputed image because of their large market capitalization. These are less volatile, provide higher stability, and are well-known as safer investment options compared to other stocks.

They are very consistent regarding dividends and highly liquid because of their high trading volume on stock exchanges.

Growth Stocks

These stocks generally grow at a better rate compared to other stocks and overall market trends of the nation. These stocks are more likely to give a better capital appreciation than other stocks due to rapid growth. Such growth companies reinvest their profits and revenue back into the company rather than paying dividends issuing bonuses or splitting the stocks.

These stocks have a higher risk because of their uncertain and rapid growth potential. The most common sectors for such stocks are technology, healthcare, and consumer goods brands.

Value Stocks

Companies that are undervalued in the market but have strong fundamental and financial statements. These stocks are known as value stocks or undervalued stocks. These stocks trade at a price lower than their intrinsic value compared to the fundamental balance sheets.

These stocks regularly pay dividends to their investors and have a high potential for growth once the market recognizes their real value. These stocks are generally less volatile.

Dividend Stocks

These companies generally distribute their profit in small portions to their shareholders in the form of dividends. Some of the main characteristics of these stocks are

- Provide regular income through consistent dividend payouts.

- These companies are financially more stable than others.

- Have low risk in comparison to other companies such as value & growth stocks.

- Dividend-paying stocks are best for those investors who are looking for a fixed income such as retired professionals etc.

Penny Stocks

These are stocks of small companies that trade at low prices, typically below Rs 10. These companies are very risky and highly volatile because of their low prices and their low liquidity is also a major problem. Investment in such companies is a major form of gambling and has a high possibility of becoming zero. These companies have a low market capitalization and hence they require proper research before investing money.

Defensive Stocks

Stocks of these defensive companies provide stable returns to their investors during all market conditions and are stable in economic downturns also. Sectors such as consumer goods, healthcare, and staple items belong to the category of defensive stocks. These companies show lower volatility in the market and also pay regular dividends to shareholders.

Cyclical Stocks

These stocks perform in a particular time duration of an economic cycle becoming its reason for better performance during economic expansions and poor performance during recessions and inflating months.

Hence, Indian stock markets provide a variety of stocks for investments based on different strategies, risk appetites, and financial goals. Understanding each stock type helps investors build a balanced and effective portfolio for wealth generation.

What is Fundamental Analysis in the Stock Market?

Fundamental Analysis is a core skill to win while entering into long-term investing, providing a deep insight into the intrinsic value of a stock. Fundamental analysis doesn’t focus on price action and trading volume like technical analysis.

Understanding Fundamental Analysis

Fundamental analysis is a cornerstone approach in the world of investing, providing a way to evaluate a company’s financial health and thus, determine its intrinsic value. The goal is to ascertain if a stock is overvalued or undervalued by the market by examining the financial statements, industry conditions, key ratios, and other economic factors. Investors use fundamental analysis to identify the undervalued stocks, betting on their potential for long-term growth.

Fundamental analysis appeals to long-term investors who focus on the company’s values and business model rather than the market trends. For instance, Rakesh Jhunjhunwala, a prominent name in the Indian stock market, is famous for his long-term investing, with some investments being decades long. Even Warren Buffet, one of the most successful investors, also relies on fundamental analysis for making investment decisions, looking out for companies with strong fundamentals promising future gains.

Here are the key components of fundamental analysis:

Financial Statements

Financial statements are pretty much the backbone of fundamental analysis and provide details about a company’s performance. Core financial statements include a balance sheet, income statement, and cash flow statement, each of which gives a unique insight into the company’s financial condition.

- Balance Sheet: This statement offers an overview of a company’s assets, liabilities, and amount invested by the owners, at a specific point in time. It tells about the company’s financial stability, liquidity, and capital structure. Simply put, a balance sheet is a snapshot of a company’s financial status. According to the Companies Act, 2013 it is mandatory for companies to publish their audited balance sheet, annually.

- Income Statement: Also known as the profit and loss statement, it helps to understand a company’s financial health. The profit or loss is calculated by taking all the revenue and subtracting all the expenses from it. This report shows a company’s revenues, expenses, and profits over a period.

- Cash Flow Statement: This statement shows a company’s cash inflows and outflows over a period. It is divided into operating activities, investing activities, and financing activities. The current cash flow for a given period can be determined by reducing the opening balance of a given period from its closing balance. A positive cash flow indicates that the company is generating sufficient cash to maintain and grow its operations.

Financial Ratios

Financial ratios are a critical tool in fundamental analysis and help turn data into insights. They provide a quantitative measure of a company’s financial performance by refining complicated financial data into easy-to-understand metrics, helping investors to compare the performance of various companies. Some important financial ratios include:

- Liquidity Ratios: We know that companies need liquidity to pay their expenses, the liquidity ratio measures a company’s ability to meet its short-term financial obligations. This can be calculated by comparing a company’s most liquid and its short-term liabilities. Common examples of liquidity ratios are the current ratio and quick ratio.

- Profitability Ratios: These assess a company’s ability to generate profit relative to its revenue, assets, or equity. In simple words, it measures how a company generates profits using available resources in a specific period. They are very useful to compare one’s performance with their previous self or with other similar companies. Examples of profitability ratios include gross profit margin, operating margin, net profit margin, return on assets (ROA), and return on equity (ROE).

- Leverage Ratios: Companies often take debt to finance their operations, leverage ratios help to calculate how much debt a company has. These evaluate the level of a company’s debt relative to its equity. Some examples of leverage ratios are the debt-to-equity ratio and interest coverage ratio.

- Efficiency Ratios: This measures how effectively a company utilizes its resources, such as assets and capital to produce sales and generate income. Examples of efficiency ratios include inventory turnover, accounts receivable turnover, and asset turnover.

Valuation Methods

Valuation methods help in determining whether a stock is undervalued or overvalued based on its intrinsic value. It includes detailed analysis of historical as well as current data. Several valuation methods are available, and the company may decide the one that best suits them.

- Discounted Cash Flow (DCM): This method estimates a company’s value by projecting its future cash flows and calculating them back to their present value using a discount rate. It is widely regarded for its thoroughness, as it takes into consideration the time value of money and future growth prospects.

- Price to Growth (PEG) Ratio: The PEG ratio tells you how expensive a stock is relative to its growth rate. To calculate the PEG ratio, the P/E (Price to Earning) ratio is divided by earnings growth. A lower PEG ratio suggests that a stock is more attractively priced relative to its growth potential.

- Dividend Discount Model (DDM): This model values a stock based on the present value of its expected future dividends. It’s particularly useful for evaluating dividend-paying companies, as it focuses on the income generated for shareholders.

- Comparable Company Analysis (CCA): it is valuable to determine a company’s fair value. CCA involves comparing the valuation metrics of a specific company to those of other similar companies in the industry.

Fundamental analysis presents a strong framework to evaluate a company’s financial health and intrinsic value. By exploring financial statements, leveraging key ratios, and applying various valuation methods, you can make informed investment decisions grounded in a company’s actual performance and potential. This analyzing approach enhances investment strategies and is great for you if you are in the pursuit of long-term financial growth and stability.

What is Technical Analysis in the Stock Market?

Understanding Technical Analysis

Technical analysis offers investors and traders a comprehensive toolkit for predicting future price movements based on historical market data, primarily price and volume, to forecast future price movements. This approach assumes that all known information is already reflected in stock prices, and patterns or trends tend to repeat over time. Technical analysts use various tools and indicators, such as moving averages, relative strength index (RSI), and candlestick charts, to identify trends and potential entry or exit points.

Ashwani Gujral is an Indian investor known for his expertise in technical analysis. Apart from him, names such as Charles Dow, William P. Hamilton, and Robert Rhea are considered the pioneers of technical analysis.

Let’s discuss the key components of technical analysis.

Charts

Charts are the primary tools in technical analysis, providing a visual representation of historical price movements and helping identify trends and patterns. They are of various types, each offering unique insights:

- Line Charts: These are the simplest form of charts and display the closing prices of a security over a particular period. They are simple and easy to understand but lack detailed information about price movements within the period.

- Bar Charts: These charts show the opening, closing, high, and low prices for each period. They are more detailed than a line chart and provide more information, which helps to assess volatility and price range within a specific timeframe.

- Candlestick Charts: These charts also show the open, high, low, and close prices but use different colors. Each “candlestick” shows the opening, closing, high, and low prices, with the body color indicating whether the price closed higher (usually green) or lower (usually red) than it opened. Originating in Japan, these are widely used in technical analysis due to their visual appeal and ability to convey a lot of information.

Trends

Trends represent the general direction in which prices are moving. They are based on historical prices, but their purpose is to forecast future trends, helping the investors to plan an entry or exit. There are three main types of trends:

- Uptrend: It is by higher highs and higher lows; an uptrend suggests that the market is generally moving upward. It indicates a bullish market sentiment. This is when the investors typically look for buying opportunities.

- Downtrend: It happens when the price is consistently making lower highs and lower lows, suggesting that the market is moving downward. It indicates a bearish market sentiment. Traders often seek selling or shorting opportunities in a downtrend.

- Sideways Trend: When prices move within a horizontal range, with no clear upward or downward direction, forming neither higher highs nor lower lows, the market is considered to be in a sideways trend. It indicates a period of consolidation. During this phase, traders might wait for a breakout in either direction.

Indicators

Technical indicators are mathematical calculations based on price, volume, or open interest data. They help identify trends, momentum, and potential reversal points providing additional insights into market conditions to help traders make informed decisions. Some widely used indicators are:

- Moving Averages: Moving averages are used to smooth out price data and identify the direction of a trend. The two main types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Crossovers between short-term and long-term moving averages often signal potential buy or sell opportunities.

- Relative Strength Index (RSI): This is a momentum oscillator, that measures the speed and change of price movements, ranging from 0 to 100. An RSI above 70 suggests that a stock is overbought, while an RSI below 30 indicates it is oversold. These levels help traders identify potential reversal points.

- Moving Average Convergence Divergence (MACD): This is a trend-following indicator that highlights the relationship between two moving averages of a security’s price. The MACD line crossing above the signal line can indicate a bullish trend, while crossing below it might signal a bearish trend.

- Bollinger Bands: These consist of a moving average and two standard deviation lines, above and below it which provide a visual representation of volatility and potential price breakouts. Prices moving outside the bands might signal overbought or oversold conditions.

Candlestick Chart Patterns

The patterns are specific formations created by price movements, signaling potential future behavior. Common patterns include:

- Head and Shoulders: It is a reversal pattern that indicates a change in trend, It consists of three peaks – a middle peak (head) being the highest, between two smaller peaks (shoulders). An inverse head and shoulders pattern suggests a potential upward reversal.

- Triangles: They are a continuation pattern formed by converging trendlines, which can be ascending, descending, or symmetrical. Ascending triangles signal an upward breakout while descending triangles suggest a downward breakout.

- Double Top and Double Bottom: These reversal patterns occur after an uptrend or downtrend, respectively. They consist of two peaks or troughs at approximately the same level. – A double top forms two peaks at roughly the same level, indicating a potential bearish movement. Conversely, a double bottom forms two troughs, signaling a potential bullish movement.

- Flags and Pennants: These continuation patterns are short-term consolidation patterns that indicate a brief pause in the current trend before it resumes. They are typically seen right after a quick, big move.

Technical analysis equips traders with tools like charts, trends, indicators, and patterns to help them help them navigate the complexities of the stock market and capitalize on the opportunities available to them. Historical data and market psychology are the foundation of this approach and can provide great insights to people looking for short-term investment and might also come in handy while making long-term investment decisions.

Comparison

| Category | Fundamental Analysis | Technical Analysis |

| Objective | Determine a company’s intrinsic value. | Predict future price movements. |

| Approach | Long-term investment. | Involves analyzing charts, and trends. Patterns and indicators. |

| Involves analysing charts, and trends. Patterns and indicators. | Period | Ideally for short-term investment, can also help with long-term investment. |

Conclusion

While both fundamental and technical analyses offer valuable insights, they cater to different investment styles. Fundamental analysis is suited for investors looking for long-term value and stability, emphasizing a deep understanding of a company’s financial health. Technical analysis, conversely, is ideal for traders seeking to profit from short-term price movements, relying on historical data and market psychology.

Although many investors find value in combining both fundamental and technical to make more informed decisions. This combined approach can help provide a more comprehensive view of the company’s value and price movements.

Some people prefer the intrinsic value focus of fundamental analysis whereas others find the trend-based approach of technical analysis more helpful. Each provides a unique lens through which to view the market, offering diverse strategies to achieve financial goals. Both approaches work differently for different individuals, you can decide to stick to the one that works best for you or understand both methods to enrich your investor’s toolkit.

Investing strategies: Long-term vs Short term

Investing is an important aspect of financial planning, providing you an opportunity to grow wealth, achieve financial goals, and ensure future financial stability. It’s not just about putting money into assets; it’s about having a strategy that aligns with your personal financial goals and timeline. There are primarily two strategies: long term and short term and if you’re considering investing your hard-earned money, it’s crucial to understand the difference between the two. Both these approaches have their own set of characteristics, advantages, and disadvantages, that an investor must consider before investing.

Long term investing

We are living in a fast-paced world where the charm of quick gains often, overshadows the enjoyment of delayed gratification, and the same applies to the financial landscape. Long-term investing is not only about buying and holding assets for a long time but also an intentional decision that will build financial security as well as withstand market fluctuations. This strategy focuses on gradual wealth accumulation and benefits from the power of compounding returns. Whether you want to grow your wealth or save for your children’s education, understanding the fundamentals of long-term investing is essential to achieve your goals.

- Setting clear goals: For a successful long-term investment, it is important to set clear and achievable financial goals. Whether it is retiring comfortably, building a home, or securing your child’s future, defining these goals helps in creating your investment strategy. By aligning these goals with your investment, you create a roadmap that guides your financial decisions and keeps you motivated during market fluctuations.

- Choosing the right investment: To find the right investment for yourself, you must take into consideration, your risk tolerance, time horizon, and financial goals. Stocks, bonds, mutual funds, and real estate are common options, each with unique advantages and risks. To build a tailored portfolio, research potential investments, and analyze historical performance.

- Risk and return dynamics: Every investment involves a relation between risk and potential return. In long-term investing, understanding this relationship is key to making informed decisions. Higher-risk investments like stocks offer the potential for greater returns over time, but they also come with increased volatility. Whereas bonds and other fixed-income securities may provide stability but generally offer lower returns. Diversify your portfolio, to mitigate the risks and maximize the returns in the long run.

- Monitoring and adjusting your portfolio: Periodically reviewing your investments allows you to assess your performance against your goals, rebalance allocations as necessary, and take advantage of new opportunities. This proactive approach helps maintain portfolio alignment with your evolving financial circumstances and market conditions.

Long-term investing strategies typically include:

- Buy and Hold Strategy

It is a long-term approach where investors purchase securities and hold onto them for extended periods, typically years or even decades regardless of market fluctuations. The strategy is rooted in the belief that over time, the stock market tends to appreciate, and quality companies with strong fundamentals will increase in value, despite short-term market volatility.

- Growth Investing

It is a strategy where investors focus on companies that are expected to grow at an above-average rate compared to their industry or the overall market. These companies typically reinvest their earnings into expanding their business operations, developing new products, or entering new markets. Growth investors are often willing to pay a premium for these companies because of their potential for significant capital appreciation over time.

- Value Investing

It is a strategy where investors seek to identify undervalued stocks trading at prices below their intrinsic value. These stocks are typically perceived to be priced lower than their fundamental worth due to market inefficiencies, investor sentiment, or temporary setbacks. Value investors believe that over time, the market will recognize the true value of these stocks, leading to capital appreciation.

Pros and cons of long-term investment

| Pros | Cons |

| Allows investments to grow exponentially over time due to compounding returns. | It can tie up capital for extended periods, reducing flexibility to respond to immediate financial needs. |

| Less impact of short-term market volatility, as they focus on the overall trend of market growth | The substantial returns are not guaranteed, market fluctuations or economic downturns can impact returns negatively. |

| Investments held for more than one year are often subject to lower tax rates. | Holding onto investments during market downturns can lead to missing out on opportunities with potentially higher returns. |

Short term investing

Short-term investing provides opportunities for quick gratification and capitalizing on market fluctuations. Unlike long-term strategies that prioritize steady growth over time, short-term investing focuses on making the most of immediate opportunities to generate quick returns. This approach requires active management, technical analysis, and a keen understanding of market trends. Whether you’re looking to supplement income, capitalize on market volatility, or test your trading skills, understanding the principles and strategies of short-term investing is essential for navigating this fast-paced financial landscape effectively. Here are key features and considerations of short-term investing:

- Setting clear goals: Define clear and realistic financial goals, whether you wish to generate supplemental income, build capital quickly, or take advantage of market opportunities, having a precise objective helps shape your investment strategy.

- Choosing The Right Investment: Successful short-term investors often focus on assets and securities that exhibit volatility and liquidity, allowing for swift entry and exit strategies. Stocks with high trading volumes, options contracts, and currencies are popular choices.

- Risk and Return Dynamics: Short-term investing entails higher risks compared to long-term strategies due to the shorter holding periods and increased market volatility.

- Monitoring and adjusting your portfolio: Short-term investing demands active portfolio management and continuous monitoring of market conditions and investment performance. It is important to regularly review your positions and market trends to maintain profitability.

Popular strategies for short-term investing encompass:

- Day Trading

It is a fast-paced trading style where traders buy and sell financial instruments within the same day to capitalize on short-term price movements. This approach requires a keen understanding of market dynamics and technical analysis tools such as charts, indicators, and real-time data feeds.

- Swing Trading

It involves holding positions for several days to weeks, aiming to profit from price swings within a trend or range. Swing traders have more flexibility as compared to day traders and they do not need to make decisions as quickly. They rely on technical analysis for identifying entry and exit points, using indicators, chart patterns, and market trends.

Pros and cons of short-term investment

| Pros | Cons |

| It yields rapid gains from price movements. | They are prone to market volatility and price fluctuations over brief periods. |

| Investors get more flexibility and can adjust their strategies quickly in response to market changes. | Rapid trading may not capture the full potential of compounding returns over time. |

| They generally carry lower exposure to market risks, such as economic downturns, geopolitical events, or changes in regulatory policies. | Profits from short-term investments are generally higher than long-term capital gains tax rates. |

Choose the right strategy for yourself

The choice between long-term and short-term investing depends on several factors, consider these when deciding which strategy aligns best with your goals:

- Financial Goals: Align your investment strategy with your long-term financial objectives. Short-term strategies may be more suitable for immediate income needs while long-term strategies align with wealth accumulation and retirement planning.

- Risk Tolerance: Can you tolerate short-term market fluctuations, or do you prefer a more stable, gradual approach? Assess your comfort level with risk and volatility, to determine which strategy is more suitable.

- Time Horizon: Consider the time frame and decide for how long do you plan to invest before needing to access your funds? Long-term investing requires less active management compared to short-term trading.

- Market Knowledge: Short-term trading requires a deep understanding of technical analysis and market dynamics, whereas long-term investing focuses more on fundamental analysis and economic trends.

- Personal Preference: Are you comfortable with active portfolio management and making frequent trading decisions, or do you prefer a hands-off, buy-and-hold strategy? It’s up to you!

Conclusion

At last, the decision between long-term investing and short-term investing depends on you and your goals. Long-term investing offers stability and growth potential, making it ideal for achieving financial goals over time. Conversely, short-term investing provides agility, and profit potential from market fluctuations, and requires active management.

Finding the right balance between the two approaches is the key to building a diversified investment portfolio that meets your financial objectives.

How to Build a Stock Portfolio in India

Building a strong stock portfolio is like cooking a tasty recipe, it requires a fusion of ingredients, careful preparation, and a dash of love to achieve a delicious outcome. Just as a chef selects the freshest ingredients, an investor carefully chooses stocks to construct a portfolio that balances risk and reward, aligning with their financial goals. Investing in the stock market requires a blend of strategic thinking, thorough research, and disciplined execution. Whether you are new to investing or looking to revamp your portfolio, understanding the fundamental principles of building a stock portfolio is crucial for long-term success.

India’s stock market, primarily by the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), offers a diverse range of investment opportunities across various sectors and industries. In this blog, we’ll explore how you can mix the right elements to cook up a successful investment strategy and savor the taste of financial success!

Diversification and Risk Management

Diversification is the process of expanding investments across various asset classes, industries, and geographical regions, intending to reduce the impact of potential losses in any single investment and create a balanced portfolio that can weather market fluctuations. In the investing world, it is often referred to as the ‘only free lunch’ as it allows investors to reduce the risk without losing on potential returns.

Key diversification strategies to mitigate the risk:

- Asset Class Diversification: Allocate your investments across various asset classes such as stock market, bonds, real estate, cash, commodities, etc., and evaluate what portion of the portfolio to allocate to each. Equities typically offer higher potential returns but also come with greater volatility compared to bonds and cash.

- Sector Diversification: Spread your investments across different sectors such as Information Technology, Pharmaceuticals, Banking, Consumer Goods, and Energy. This helps reduce the risks associated with sector-specific downturns or regulatory changes impacting a particular industry.

Asset Allocation

Asset allocation is the strategic distribution of your investment capital among different asset classes, such as stocks, bonds, and cash, to achieve your financial objectives while managing risk. It serves as the foundation of your investment strategy and should be aligned with your risk tolerance, investment goals, and time horizon. There’s no right way to allocate your assets, it is a personal decision and differs for everyone. For instance, investors with specific financial goals, such as funding education or buying a home, may tailor their asset allocation to align with their timeline and liquidity needs.

Factors Influencing Asset Allocation

- Risk Tolerance: Assess your ability to tolerate market fluctuations that will affect the value of your investments. Younger investors often lean towards allocating a larger portion of their portfolio to higher-risk assets like stocks. In contrast, older investors those nearing retirement may opt for a more conservative allocation, prioritizing safer assets such as bonds and cash equivalents.

- Investment Goals: Define your short-term and long-term financial goals, such as retirement planning, education funding, buying a house, or wealth accumulation. These objectives should be reflected in your asset allocation strategy.

- Time Horizon: How long you plan to invest, affects how risky your investments can be. If you have a long time before you need your money, you might invest more in things like stocks for higher growth. If you need your money sooner, you’ll likely choose investments like bonds or cash and have it ready when you need it.

Allocate your investments across different asset classes (equities, bonds, cash) to balance returns and risk.

Sector Allocation

Sector allocation refers to the strategy of dividing an investment portfolio among different sectors or industries, within the market. This approach is used to manage risk and optimize returns by spreading investments across various sectors that may perform differently under different economic conditions. The decision is based on various factors like growth of the sector, market dynamics, and personal financial condition. In India, where certain sectors have historically outperformed others, sector allocation can play a crucial role in maximizing returns.

Factors Influencing Asset Allocation

- Risk Tolerance: Investors with a high-risk tolerance may be more willing to allocate a larger portion of their portfolio to sectors that are traditionally more volatile but offer higher potential returns, such as technology or emerging markets instead of more stable sectors like utilities or consumer staples, which are less prone to sharp price fluctuations.

- Investment Goals: investors willing to generate income, may allocate more to sectors with consistent dividends, such as utilities or real estate investment trusts (REITs). Whereas someone who wants to preserve their capital would go for less volatile sectors like healthcare.

- Time Horizon: Investors with a short-term horizon may focus on sectors that are expected to perform well soon, based on current economic conditions and market trends. Long-term investors have the luxury of riding out short-term volatility and may allocate more to growth sectors like technology or renewable energy.

Allocate investments across sectors with complementary growth profiles to achieve a balanced portfolio.

Stock Picking Tips

Stock picking is the process of selecting individual stocks that align with your investment goals and have the potential to give great returns. Whether you prefer technical analysis or rely on fundamental indicators, effective stock picking requires attention, research, and a systematic evaluation of company fundamentals and market trends. Here are some effective stock-picking strategies to keep in mind:

- Technical Analysis: Make use of technical indicators like Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence), to study the movement of stock prices. They will help you analyze market trends, and identify entry and exit points.

- Fundamental Analysis: Evaluate a company’s financial health, profitability, revenue growth, competitive positioning, and management quality using metrics like Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Debt-to-Equity ratio to get insights into a company’s valuation and financial stability.

- Research: Stay updated on company developments, quarterly earnings reports, product launches, and other strategic initiatives. Understand the industry dynamics, competitive landscape, and regulatory environment, which affect the company’s operations and growth.

- Diversified portfolio: Spread your investments across multiple stocks to reduce individual stock risk and capture diverse growth opportunities. Consider factors such as market capitalization, sector allocation, and geographic diversity when building your stock portfolio.

Conclusion

Building a stock portfolio requires a diversified approach to ensure that your investments across asset classes and sectors are strategically allocated based on your risk tolerance and investment goals. Conduct thorough research to identify promising stocks, enhance the resilience of your portfolio, and optimize returns over time.

Remember, investing in the stock market involves risks, and market conditions can fluctuate based on various factors such as economic factors, geopolitical events, and sector-specific developments. Stay informed about market trends, monitor your portfolio’s performance regularly, and adjust your investment strategy as and when needed to adapt to changing market dynamics.

Risk Management in Stock Investing

Investing in the stock market can be exciting, offering opportunities for significant returns but also carries inherent risks. Effective risk management is crucial for protecting your investments, ensuring long-term success, and navigating the unpredictable nature of financial markets. In this blog, we’ll delve into key strategies and concepts every investor should understand and implement to manage risk effectively.

Understanding Market Risk and Volatility

Market Risk: Market risk is an ever-present reality in the world of stock investing. Also known as systematic risk, it refers to the possibility of losses due to factors that affect the whole market, instead of specific or individual stocks. These factors include economic downturns, geopolitical events, changes in interest rates, and overall investor sentiment. Market risk cannot be eliminated but can be well managed through diversification and other strategies.

Volatility: It refers to the degree of variation in a stock’s price over time. It measures the magnitude and frequency of price fluctuations, both upward and downward, within a specific period. Highly volatile stocks can experience rapid and unpredictable price movements, presenting both opportunities and risks. Investors must assess their risk tolerance and investment goals when considering volatile stocks.

- Setting Stop-Loss Orders

A stop-loss order is an essential tool for investors, offering a structured approach to risk management in the unpredictable world of stock trading. It is a risk management tool that instructs your broker to sell a stock when it reaches a certain price, thereby limiting potential losses. It acts as a safety net, automatically triggering a sale to prevent further downside if the stock price moves against your position.

When setting a stop-loss order, investors typically choose a price point below the current market price. The exact level should consider the stock’s volatility, investment goals, and risk tolerance. For example, a conservative investor might set a tighter stop-loss (e.g., 5-10% below purchase price), whereas a more aggressive investor might tolerate a wider range (e.g., 15-20%).

Pros and Cons

| Pros | Cons |

| Helps protect capital by limiting losses during market downturns. | Over-reliance, can lead to frequent trading and increased transaction costs. |

| Provide a disciplined approach to trading, removing emotional decision-making from the process. | In fast-moving markets, its execution price may differ from the specified stop price. |

| In highly volatile markets, it can prevent significant losses due to rapid price movements. | During volatile market conditions, it can trigger premature sales, which may result in missed opportunities if the price rebounds. |

- Hedging

It involves making another investment that will offset any losses in your main investment if its value goes down. The goal of hedging is not to eliminate risk entirely but to mitigate the impact of adverse market movements and protect your portfolio.

Types of Hedging Strategies

- Options Hedging: Options hedging is like buying insurance for your investments. Options are contracts that give you the right to buy or sell stocks at a prefixed price by a specific date. You can use options to hedge against downside risk, which essentially means taking out insurance against potential losses in your investments.

- Future Contracts: Futures contracts allow you to lock in prices for future transactions. They’re like making a deal now to buy or sell something later, at a fixed price. They are commonly used to hedge against price fluctuations in commodities or indices that may impact related stocks.

- Diversification: Diversifying your portfolio across different asset classes, industries, and geographic regions can reduce the risk, during market downturns. A well-diversified portfolio is less vulnerable to losses from adverse events affecting a specific sector or market.

- Short Selling: it involves selling borrowed shares with the intention of buying them back at a lower price. While it is risky and complex, it can be used as a hedge against a decrease in the value of stocks you already own.

- Pros and Cons

| Pros | Cons |

| Minimizes potential losses if the market moves against your investments. | Can involve fees and expenses that affect your overall investment returns. |

| Helps to maintain consistency in your investment returns, even during market ups and downs. | Some methods can be tricky or complex to understand. |

| Helps in tailoring your investment approach to fit your goals and risk tolerance. | Depends a lot on timing and how well it matches the risks you’re trying to protect against. |

Conclusion

Effective risk management is essential for navigating the uncertainties of the stock market. By understanding market risk and volatility and implementing risk management strategies like stop-loss orders, and hedging, investors can protect their capital and improve their chances of achieving long-term investment success. Remember, while no strategy can eliminate risk entirely, a disciplined approach to risk management can help you weather market fluctuations and capitalize on opportunities as they arise.

The Impact of Economic Indicators on the Indian Stock Market

The Indian stock market is significantly influenced by a variety of economic indicators that reflect the health and stability of the country’s economy. Represented primarily by indices such as the BSE Sensex and NSE Nifty, it serves as a measure of the country’s economic health and investor sentiment. Economic indicators provide insights into the overall economic performance, growth prospects, and stability, influencing market trends and stock valuations.

Understanding these indicators and their impact on stock prices is crucial for investors, policymakers, and analysts. In this blog, we explore some key economic indicators and their effects on the Indian stock market.

Economic Indicators

Economic indicators are statistical metrics used to assess the overall health and performance of a country’s economy. They provide valuable insights into economic trends, growth prospects, and potential risks to make an informed decision. These indicators encompass a wide range of factors, such as:

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced within a country’s borders over a specific period, usually annually or quarterly. It serves as a primary indicator of economic growth and productivity.

Strong GDP growth is associated with higher corporate profits, increased consumer spending, and overall positive economic health. This leads to bullish sentiment in the stock market, with investors anticipating higher earnings and stock prices. Conversely, a slowdown in GDP growth or contraction can reduce investor confidence, leading to a decline in the market.

- Inflation Rate: Inflation refers to the rate at which the general level of prices for goods and services is rising within an economy. It reflects changes in purchasing power and the cost of living.

High inflation rates can destroy consumer purchasing power, reduce corporate profitability, and increase operating costs. Sectors such as consumer goods, retail, and hospitality may face challenges as input costs rise. Central banks, including the Reserve Bank of India (RBI), monitor inflation closely and adjust monetary policies, including interest rates, to control the pressure and maintain price stability.

- Unemployment Rates: The unemployment rate measures the percentage of the labor force that is actively seeking employment but is currently unemployed. It indicates the health of the job market and consumer confidence.

High unemployment rates indicate economic weakness, lower consumer spending, and reduced corporate earnings. This can lead to cautious investor sentiment and potential declines in stock prices, particularly in sectors dependent on voluntary consumer spending. On the other hand, declining unemployment rates signal economic strength, potential wage growth, and increased consumer confidence, which can bolster stock market performance.

Interest Rates and RBI Policies

The RBI is India’s central bank, responsible for maintaining monetary stability and promoting economic growth. It plays a pivotal role in shaping India’s economic landscape through its monetary policies, aimed at achieving price stability, ensuring adequate liquidity in the financial system, and fostering sustainable economic development.

Interest rates, determined by the RBI play a critical role in shaping economic activity and investor sentiment in India. It represents the cost of borrowing money or the return on savings.

Lower interest rates revive borrowing and investment, benefiting sectors such as housing, automobiles, and infrastructure. Lower borrowing costs can also enhance corporate profitability and boost stock prices. Conversely, higher interest rates can slow down economic growth, increase borrowing costs for businesses and consumers, and lead to lower stock valuations, especially in interest-sensitive sectors.

Global Economic Events

Global economic events have a significant influence on the Indian stock market, impacting investor sentiment, market volatility, and economic outlook. Global economic events encompass a wide range of factors that affect economies worldwide. These events include:

- Geopolitical Tension: Political conflicts, trade disputes, and strained diplomatic relations between countries can shake global trade, supply chains, and economic stability.

- Trade Agreements and Policies: Trade agreements, tariffs, and trade policies implemented by major economies influence global trade flows, commodity prices, and economic growth prospects.

- Economic Policies: Monetary policies and regulatory changes enacted by central banks and governments impact economic conditions, investment flows, and financial markets all around the world.

As India becomes more connected globally, events beyond its borders can significantly affect economic growth, trade, and how investors feel. For example, changes in global trade policies or economic conditions can impact how much India exports and imports. This affects industries like IT and manufacturing, which are key to India’s growing economy. By understanding how global events influence our country, we can better manage risks and find opportunities in the changing world of finance.

Conclusion

The Indian stock market is linked to a complex web of economic indicators, both domestic and global. These indicators collectively shape investor sentiment, market volatility, and stock price movements. For stakeholders in the financial markets, understanding these indicators and their relationship is crucial to navigating risks, identifying investment opportunities, and making informed decisions. As India continues to integrate into the global economy and undergo economic reforms, the role of economic indicators in driving stock market dynamics will remain of utmost importance.

Tools and Platforms for Stock Trading in India

Thanks to technological advancements and increasing investor participation, the stock trading landscape in India has undergone an extreme transformation, in recent years. Nowadays, traders have access to a wide range of tools and platforms that cater to diverse trading styles and preferences, from online brokers and trading platforms to stock market analysis tools and intuitive mobile trading apps. Whether you’re a seasoned trader or someone just starting out in the world of stocks, having access to the right tools can make a substantial difference in your trading experience. This blog delves into the essential tools and platforms available for stock trading in India, empowering investors to navigate the complexities of the financial markets effectively.

Online Brokers and Trading Platforms

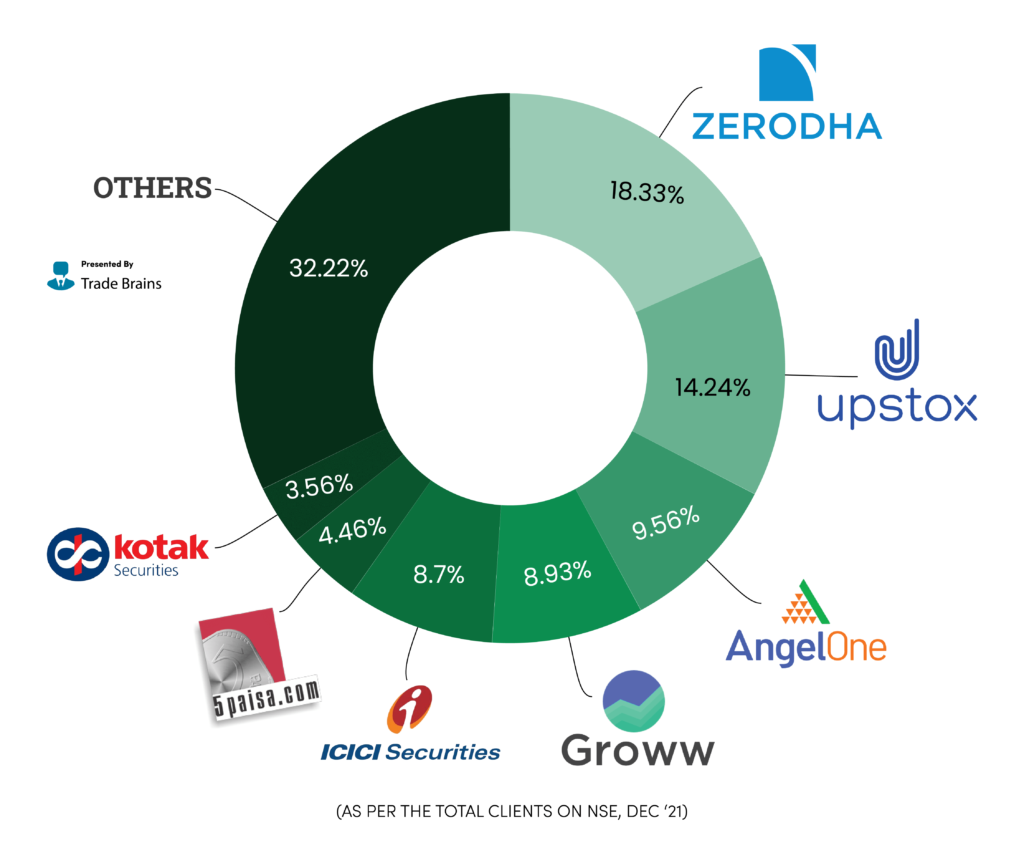

Stocks are traded in stock exchanges (BSE, NSE, etc.) and to buy and sell shares in stock exchanges, investors require a stockbroker. Traditionally, one would talk to a stockbroker in person or via a call but now, online brokers and trading platforms have revolutionized how individuals engage in stock trading. They provide easy access to all the market data, trading tools, and pricing structures, making them essential for both long-term and short-term investors.

Here’s an overview of some of the prominent online trading platforms in India:

- Zerodha

Zerodha is one of the largest retail stockbrokers in India known for its innovative approach and competitive pricing structure. Founded in 2010, it has been a trailblazer in the Indian stock brokerage industry, gaining a massive following among traders due to its user-friendly interface and low brokerage fees. Key features of Zerodha are:

- Kite: Zerodha’s flagship trading platform, Kite, offers a sleek and intuitive interface designed for efficient order execution across equities, derivatives, commodities, and currency segments. It provides real-time market data, advanced charting tools, and customizable dashboards.

- Coin: It is a direct mutual fund platform that allows investors to buy mutual funds directly from asset management companies, without paying any commissions. It simplifies the investment process by offering paperless transactions and systematic investment plans (SIPs).

- Varsity: This is an educational initiative, started by Zerodha, which provides comprehensive tutorials, articles, and courses covering various aspects of trading, investing, and financial markets. It is a valuable resource for both beginners and experienced traders looking to hone their skills.

- Upstox

Upstox has emerged as a prominent player in the online trading space, offering a feature-rich platform designed to cater to the diverse needs of traders. It aims to democratize access to financial markets through its platform. Established in 2012, Upstox focuses on providing fast order execution, advanced charting tools, and competitive brokerage rates. Key features of Upstox include:

- Upstox Pro: Upstox Pro is a powerful, feature-rich trading platform available on both web and mobile devices, offering real-time market data, technical analysis tools, and customizable watchlists. It supports various order types and provides traders with insights into market trends and stock movements.

- Developer API: Upstox offers a Developer API that allows developers to build customized trading applications on the platform and integrate Upstox’s trading infrastructure with third-party platforms. This feature helps you execute real-time orders, effectively manage user portfolios, and stream live market data via Websockets, among other services, all in a user-friendly manner.

- ICICI Direct: ICICI Direct is one of India’s leading financial services firms, backed by ICICI Securities. It is a comprehensive retail trading and investment platform that integrates banking services with stock trading capabilities. It offers a seamless user experience, providing a comprehensive suite of trading and investment solutions. Key features of ICICI Direct include:

- 3 in 1 Account: ICICI Direct offers a 3-in-1 account that integrates a savings bank account, a trading account, and a demat account, providing seamless fund transfers and settlement of trades.

- Research and Insights: ICICI Direct offers extensive research reports, market analysis, and investment recommendations across equities, derivatives, mutual funds, and other asset classes. This wealth of information helps traders make informed decisions based on expert insights and market trends.

- Mobile App: ICICI Direct’s mobile trading app allows investors to trade on the go, access real-time market data, and receive alerts and notifications about their investments, on their mobile devices. The app is designed to provide a seamless and secure trading experience across mobile devices.

Stock Market Analysis Tools

Successful trading often relies on thorough market analysis and research and stock market analysis tools play a crucial role in helping traders analyze market trends, identify trading opportunities, and make informed decisions. Stock market analysis tools can vary widely depending on your needs and expertise level. Several tools and platforms provide traders with the necessary data and insights to make informed decisions, here are some essential tools widely used by traders in India:

- Moneycontrol: It is one of India’s leading financial news and analysis platforms, offering real-time market data, stock quotes, finance-related news updates, and expert analysis. It provides comprehensive coverage of Indian and global markets, making it a valuable resource for traders seeking up-to-date information and insights.

- TradingView: It is a popular charting platform that provides advanced technical analysis tools, customizable charts, and a social networking feature where traders can share ideas and strategies. It supports a wide range of technical indicators and drawing tools, allowing traders to conduct in-depth technical analysis and make informed decisions.

- Screener.in: It is a powerful tool for fundamental analysis, allowing users to screen stocks based on various criteria such as market capitalization, price-to-earnings ratio (P/E), dividend yield, and financial ratios. It provides detailed financial data and metrics, helping traders identify potential investment opportunities for themselves.

- Bloomberg Quint: It provides comprehensive market coverage, economic news, and analysis tailored to the Indian market. It offers insights into global and domestic market trends, macroeconomic developments, and corporate news, making it a valuable resource for traders and investors seeking in-depth market knowledge.

Mobile Trading Apps

In today’s era of smartphones, mobile trading apps have gained popularity among traders for their convenience and accessibility. These apps allow traders to monitor market movements, execute trades, access real-time quotes, and manage their portfolios with a few taps. Here are some notable mobile trading apps available in India:

- Zerodha Kite Mobile App

Zerodha’s Kite mobile app is an extension of its web-based platform, offering all the essential features in a compact and user-friendly interface. It offers a seamless trading experience with features such as real-time market data, customizable watchlists, and advanced charting tools. It allows traders to place orders quickly and efficiently, even when they are away from their desktops.

- Upstox Pro Mobile App

Upstox Pro mobile app is designed to provide a seamless trading experience on mobile devices, catering to the needs of both beginners and experienced traders. It provides traders with access to real-time market data, technical analysis tools, and a user-friendly interface optimized for mobile devices. It supports quick order placement and enables traders to stay informed about market developments on the go.

- ICICI Direct Mobile Trading App

ICICI Direct’s mobile trading app offers a detailed suite of features such as real-time market updates, order execution capabilities, and portfolio tracking. It is designed to provide a secure and seamless trading experience, catering to the needs of mobile-savvy traders.

Conclusion

The easy access to advanced tools and platforms has transformed stock trading in India, empowering investors with unmatched access to market data, analysis tools, and trading opportunities. Whether you prefer the functionality of online trading platforms like Zerodha and Upstox, rely on stock market analysis tools for informed decision-making, or use mobile trading apps for on-the-go trading, there are options to suit every trading style and preference. By leveraging the tools and platforms discussed in this guide, you can enhance your trading experience and work towards achieving your financial objectives in the ever-evolving world of stock.

Case Studies of Successful Indian Investors

Investing in the stock market is like exploring a maze of opportunities and risks, where making the right choices can lead to significant wealth. In India’s financial landscape, several investors have become renowned for their success and smart strategies. From navigating the ups and downs of the market to backing growing sectors, some investors have reshaped India’s stock market with their diverse approaches.

This blog explores the journeys of three iconic investors who have created a huge impact on India’s financial world: Rakesh Jhunjhunwala, Radhakishan Damani, and Porinju Veliyath. Their stories go beyond financial gains; they are about endurance, foresight, and sticking to their investment principles. Each investor’s path offers valuable lessons, join us as we explore the stories of these investment legends and learn from their journeys.

- Rakesh Jhunjhunwala

He was born and raised in Mumbai and began his career in the early 1980s. His journey, which started from a small trader with a keen interest in the stock market to one of the most successful investors in India, is a testament to his deep understanding of market dynamics. Also known as The Big Bull of the Indian Stock Market, he is renowned for his long-term investment approach, which emphasizes on fundamental analysis and requires a keen eye for identifying high-return stocks. He believes in investing in sectors poised for significant growth over time, often holding onto his investments through market cycles.

One of Jhunjhunwala’s early and most notable investments was in Titan Company Limited. His far-sightedness in recognizing the potential of India’s leading consumer goods company paid off immensely as Titan’s stock price soared over the years. Another significant success was Lupin Limited, where his investments in the pharmaceutical sector showed his ability to spot value in emerging industries.

Jhunjhunwala’s ability to stay invested in quality stocks for extended periods, even during market downturns, and his deep knowledge of market trends allows him to capitalize on emerging opportunities before they become popular. Detailed research and analysis, patience, and the resilience to withstand short-term volatility are some of the lessons you can learn from Rakesh Jhunjhunwala.

- Radhakishan Damani

Known for his low-profile demeanor and sharp business acumen, Radhakishan Damani’s journey in the stock market began as a trader in Mumbai. His investment philosophy is deeply rooted in value investing principles. Often referred to as the Warren Buffet of India, Damani focuses on investing in companies with strong fundamentals and long-term growth potential. He prefers to invest in sectors he has a good knowledge of, such as retail and consumer goods, where he can leverage his deep knowledge and insights.

Damani’s most celebrated investment is in Avenue Supermarts, the parent company of DMart. His early investment and strategic guidance helped transform DMart into one of India’s largest and most profitable retail chains. Additionally, his investments in VST Industries, a leading player in the tobacco industry, have also provided significant returns.

Damani’s success highlights the importance of staying within one’s area of expertise and how patience and a focus on intrinsic value can lead to a lot of wealth, over time. He looks for undervalued stocks with the potential for significant growth, also Damani’s conservative investment strategy emphasizes risk management and helps preserve capital.

- Porinju Veliyath

Porinju Veliyath, based in Kochi, Kerala, started his career as a financial consultant before shifting to full-time stock market investing. He is known for his contrarian investment style and flair for identifying turnaround opportunities. Veliyath’s strategy revolves around contrarian bets on small and mid-cap stocks that are undervalued or overlooked by the market. He believes in identifying companies with strong growth potential and actively involves himself in their management.

Veliyath’s active interest in the companies he invests in and willingness to go against the market consensus has significantly helped him. One of his notable investments was in Geojit Financial Services, where his early investment showcased his ability to identify emerging opportunities in the financial sector. Also, his investments in Atul Auto, an automobile manufacturer, displayed his ability to spot growth prospects in niche markets.

Conclusion

These success stories of Rakesh Jhunjhunwala, Radhakishan Damani, and Porinju Veliyath offer invaluable insights into the diverse strategies that can lead you to success in the Indian stock market. Whatever the approach might be, these investors have proven that disciplined investing and a deep understanding of market dynamics are key to achieving sustainable wealth creation over time.

These legends have not only gathered significant wealth but have also left a legacy in India’s financial markets. Aspiring investors can learn from their experiences and stories, which serve as guiding beacons for anyone looking to embark on their journey to becoming a successful investor.

Common Mistakes to Avoid in Stock Investing

Investing in the stock market acts as a gateway to gaining wealth and becoming financially independent, however, investing is not in the least bit an easy task and there is never a guarantee of returns. Investing requires more than enthusiasm and capital, it demands careful consideration, disciplined strategy, and a keen awareness of common pitfalls that can derail even the most careful investor. By understanding these pitfalls and adopting strategies to mitigate them, you can significantly improve your decision-making process and increase your chances of achieving long-term financial success.

There are hundreds and thousands of dos and don’ts about investing out there, and different things work for different people. Nonetheless, there are some common mistakes, that every investor should avoid which we’ll discuss in this blog.

- Investing Your Emotions

Emotional trading is perhaps one of the most common pitfalls in stock investing. It occurs when investors make decisions based on feelings rather than logic and analysis. Don’t let emotions like fear or greed drive your decision to buy or sell stocks impulsively. During periods of market volatility, emotions tend to run high. Investors may panic sell during market downturns, fearing further losses, or they may buy into a hot stock out of FOMO (fear of missing out). These emotionally made irrational decisions can undermine your investment goals. To overcome emotional trading, implement the following strategies:

- Know your goals: Setting clear investment goals and knowing your risk tolerance and time horizon, can help you stay focused during turbulent market conditions.

- Hang in there: Develop and stick to a well-thought-out investment plan, resisting the urge to make impulsive decisions based on short-term market fluctuations.

- Leverage the tools and resources: Make use of tools that can help you manage emotions, such as setting stop-loss orders to limit potential losses or utilizing investment apps that provide objective analysis and insights.

Example

During a market correction, Investor A panicked and sold all their stocks at a significant loss. Later, the market rebounded, and they missed out on potential gains. Whereas Investor B remained disciplined and stayed invested according to their long-term plan, which ultimately paid off as their portfolio recovered and grew over time.

- Not Knowing Your Investments, Inside Out

Investing in stocks without conducting thorough research is pretty much like gambling. Researching is crucial to understanding the fundamentals of a company, assessing its growth potential, and evaluating its competitive position within the industry. Without enough research, investors may overlook pivotal information that could, otherwise impact their investment decisions. To conduct effective research, consider the following techniques:

- Study Financial Statements: Analyse a company’s financial statements, including income statements, balance sheets, and cash flow statements to gain insights into the company’s profitability, financial health, and ability to generate cash.

- Asses the Management: Have a fair idea about the background and track record of the company’s management team. Strong and capable leadership is often a key determinant of a company’s long-term success.

- Utilize Reliable Sources: Access respectable financial news outlets, company reports, and industry analyses to acquire valuable insights into market trends, economic conditions, and specific companies or sectors.

Example

Investor A invested in a startup based solely on a friend’s recommendation, without conducting any research. Later, they got to know that the startup had significant legal issues, leading to substantial losses. Conversely, Investor B did their research and invested in a tech company, after analysing its market position, competitive advantages, and growth prospects. Their informed decision led to substantial returns as the company expanded its market share and profitability.

- Prioritize Quality

Don’t get driven by the desire to capitalize on short-term price movements, and fall prey to overtrading, which occurs when investors execute an excessive number of trades within a short period. This can result in higher transaction costs, increased taxes, and diluted investment returns. To avoid falling into the trap of overtrading, try following these strategies:

- Establish a Fixed Criteria: Define specific criteria for entering and exiting trades based on thorough analysis and your investment strategy. Avoid making trades based on emotions or just because everyone’s talking about it.

- Focus on Long-Term Goals: Stress quality over quantity by investing in companies with strong fundamentals and growth potential. Resist the urge to constantly buy and sell stocks based on short-term fluctuations.

- Monitor Trading Activity: Regularly review your trading activity and portfolio performance. Consider rebalancing your portfolio periodically to ensure it aligns with your investment goals, time horizon, and risk tolerance.

Example

Investor A frequently traded stocks based on daily market news and tips, resulting in high transaction costs and minimal gains. Their portfolio suffered from excessive turnover and lacked sustained growth. While Investor B focused on quality stocks with strong fundamentals. By limiting their trading activity to well-researched opportunities, they achieved consistent portfolio growth over time.

Conclusion

As discussed above, navigating the stock market requires discipline, patience, and a commitment to avoiding common pitfalls. Successful investing is not just about picking winning stocks; it’s about developing a strategy that withstands market volatility and delivers results. Mastering your emotions, conducting thorough research, and avoiding overtrading, are some of the strategies you can employ to enhance your ability to make informed investment decisions and achieve your financial objectives.

Resources for Continuous Learning

The pursuit of knowledge is essential for personal growth and professional success, and in the world of finance, staying ahead isn’t just an advantage—it’s crucial for success. Continuous learning will empower you to navigate complex financial landscapes, make informed decisions, and seize opportunities. Thanks to the advancement of digital technologies, accessing high-quality learning resources has never been easier. Whether you prefer the tactile experience of books, the interactive nature of online courses, or staying updated with financial news, there are numerous directions to explore, each with unique benefits that can help you achieve your goals.

Books

Books remain a reliable source of knowledge in finance, offering detailed insights and strategic perspectives on various topics. From basic principles to advanced investment strategies, books offer:

• Comprehensive Coverage: Books dive deep into complex financial concepts, providing in-depth analysis and practical applications.

• Expert Advice: Written by industry leaders, renowned experts, and experienced professionals, books share firsthand knowledge and expertise.

• Historical Context: Many books put current financial trends into historical perspective, offering valuable lessons and predictive insights.

• Personalized Learning: Whether you’re interested in mastering financial modeling, understanding market dynamics, or exploring new fintech trends, choose books that align with your personal goals.

By incorporating books into your routine, you can gain a deeper understanding of the workings of the market, refine your investment strategies, and develop strategic thinking abilities that are important for success in the financial industry.

Online Courses

The rise of online learning platforms has made financial education accessible to everyone, with courses tailored to different learning styles. Online courses offer:

• Flexibility and Accessibility: Learn at your own pace, fitting study around your personal and professional schedules.

• Interactive Learning: Engage in interactive modules, simulations, and case studies that give an idea of real-world financial scenarios, enhancing practical knowledge and decision-making skills.

• Expert Guidance: Learn from courses taught by industry experts, who provide up-to-date insights and strategic perspectives.

• Specialization Options: Choose from a variety of specialized courses, from fintech innovation to sustainable investing, to match your career aspirations.

Platforms like Coursera, edX, and Financial Modelling Institute offer comprehensive courses that combine theory with practical application, empowering you to apply what you learn directly to improve your stock market game.

Financial News and Websites

In the world of finance, staying informed is crucial for making informed decisions and seizing opportunities. Financial news sources and websites provide:

• Real-Time Updates: Access breaking news, market trends, and economic indicators that impact your investment strategy and financial decisions.

• Expert Analysis: Gain insights from financial analysts and industry leaders about emerging trends, geopolitical changes, and economic forecasts.

• Educational Resources: Many financial websites offer articles, blogs, and webinars on topics related to financial planning, asset allocation, investment strategies, regulatory changes, etc.